County of San Mateo TRANSFER TAX AFFIDAVITDTT AFFIDAVITPer San Mateo County Ordinance Code 2.93.050This form must accompany any document that requires a Documentary Transfer Tax declaration, including.

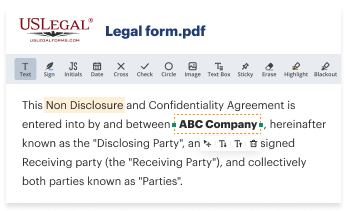

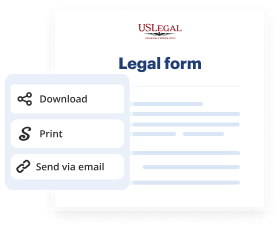

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get answers to your most pressing questions about US Legal Forms API.

San Mateo County Transfer Taxes: San Mateo County has a county transfer tax of $1.10 per $1,000, typically paid by the seller. The City of San Mateo and Hillsborough charge additional transfer taxes based on the property's value, often shared between buyers and sellers.

Yes. The Tax Affidavit is submitted to help explain the nature of the transaction and the validity of the claimed DTT exemption. Be sure to attach any required supporting documentation to prove that your claimed DTT exemption is valid.

Transfer tax is collected on sales, exchanges, legal entity changes of control and leases of more than 35 years (including options) among other forms of transfers. In Northern California the seller of the property customarily pays the transfer tax during the escrow process.

California Revenue and Taxation Code Section 11911 allows a county or city to impose DTT on “each deed, instrument, or writing” by which real property “shall be granted assigned, transferred, or otherwise conveyed.” The statute's language does not appear to permit DTT to be imposed on transfers of legal entity .

Transfer tax is collected on sales, exchanges, legal entity changes of control and leases of more than 35 years (including options) among other forms of transfers. In Northern California the seller of the property customarily pays the transfer tax during the escrow process.

Who pays closing costs in California? In California and any state, both the buyer and the seller are responsible for a portion of the closing costs in a real estate transaction. Typically the seller pays a bit more in closing costs than the buyer.

Melanie: So, basically, in San Mateo County, it is a buyer pay county which means when a buyer comes in to purchase a property, they are paying the title and escrow fees.

In Canada, no matter the province or municipality, it's the buyer that pays the land transfer tax, not the seller. Land transfer taxes are due as soon as the buyer takes possession of the property. Unlike property taxes, land transfer taxes must be paid in full as a one-time payment.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.