ATTENTION: Effective January 1, 2018, certain recordable documents will be charged an additional $75 fee to support the Building Homes & Jobs Act. Please read here for more information.

With integrity and commitment to customer service, the Office of the Assessor-Recorder is responsible for recording and preserving official documents related to marriage, real property, and business functions.

The Assessor-Recorder will record only those documents as permitted by State law. Once recorded or filed, the documents and certificates are made available for examination by interested parties upon request.

Reminder: Documents are examined only to determine if they meet “Recording Requirements,” which are very different from legal requirements. It is highly recommended that you speak with an attorney, title company representative, or other authorized individual for assistance. Only documents permitted by law may be recorded.

Documents may be submitted to our office in one of three ways:

In Person: To our City Hall location (1 Dr. Carlton B. Goodlett Place, Room 190, San Francisco, 94102). Payment for recording fees and transfer taxes (if applicable) may be made by cash, checks (with preprinted name and address), credit card, or money order payable to SF Assessor-Recorder. Note that our recording window is open from 8:00 AM to 4:00 PM.

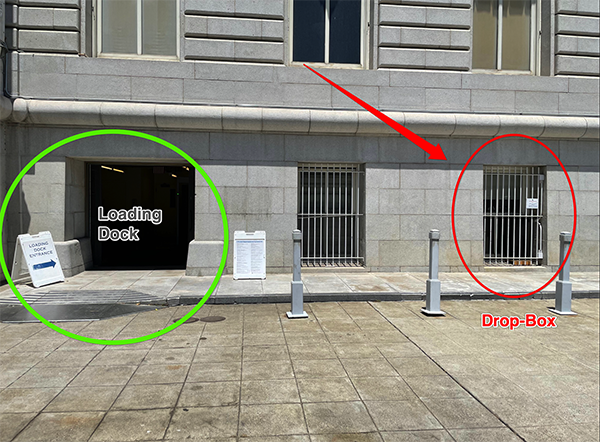

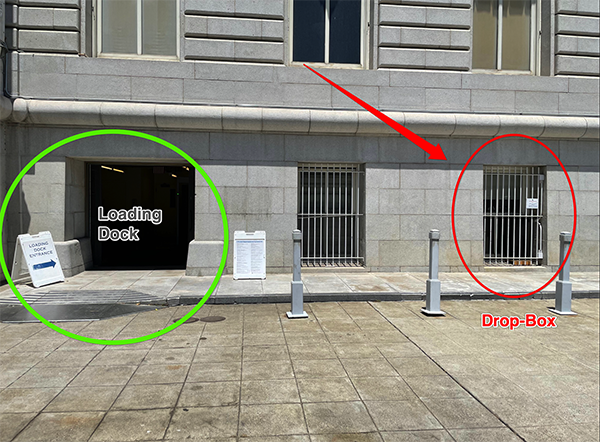

By Drop Box: The Assessor-Recorder drop box is located outside City Hall at 1 Dr. Carlton B. Goodlett Place (the box is in the window at the Grove Street entrance). The drop box is checked daily and documents are taken directly back to Assessor-Recorder staff to process. Documents submitted via drop box will be examined and recorded (if acceptable) within 24 hours of receipt. Please ensure that your documents are securely packaged with payment. Payment for recording fees and transfer taxes (if applicable) may be made by checks (with preprinted name and address), or money order payable to SF Assessor-Recorder.

By Mail: To our City Hall location (1 Dr. Carlton B. Goodlett Place, Room 190, San Francisco, 94102). Payment for recording fees and transfer taxes (if applicable) may be made by cash, checks (with preprinted name and address), or money order payable to SF Assessor-Recorder.

Electronically: Electronic Recording (e-recording) is the process of recording documents via a secure internet portal that would otherwise be sent by mail or courier to the San Francisco County Assessor-Recorder’s Office. E-recording is an efficient and secure means to submit documents to our office for recordation electronically. Once recorded, documents are returned to the submitter the same day, usually in less than an hour, and payment of recording fees and taxes are made the following day via ACH wire transfer. E-recording was previously limited to title companies, title insurers, financial institutions, and government entities. However, the regulations governing e-recording were recently updated in response to AB2143 (2016), which opens up e-recording to entities that can demonstrate at least $1 million in general liability insurance. These new regulations went into effect on January 1, 2020.

We are excited to now offer e-recording to all entities that demonstrate the minimum insurance requirements and who enter into a Memorandum of Understanding (MOU) with our office and one of our nine partner e-recording Agents. A list of authorized e-recording Agents is included in the Forms/Attachments tab. The San Francisco County Assessor-Recorder’s Office does not impose a surcharge for e-recording; the fees are the same for paper documents submitted over the counter or by mail as those arriving through e-recording. However, Agents charge Submitters a fee for the convenience of e-recording. Each Agent’s fee structure is different, so you are encouraged to inquire with the Agent for pricing.

Reminder: Although we would like to give you as much information as possible, under California law, our document examiners are PROHIBITED from providing legal advice or assisting in document preparation. ( Section 6125 of the Business and Professions Code ).