The chapter describes value creation and valuation under structural uncertainty in the healthcare and pharma industries. These risks and uncertainties can significantly influence organizational performance, value creation and long-term sustainability. The discussion continues by comparing traditional valuation concepts used in finance with the requirements posed by the current situation of healthcare business. In particular, patent valuation is a critical business issue, and the value of pharma patents and licensing deals has risen markedly in recent years. Existing evaluation approaches do not consider a patent’s life cycle, an important and unique characteristic of pharma and biotech patents. For this reason, the inherent uncertainty in a patent’s value is modelled as a stochastic process.

You have full access to this open access chapter, Download chapter PDF

The pharmaceutical industry is a key, yet complex sector within the global economy. Organizationally, its complexity is outlined by an involved business model, an intricate organizational structure, and a challenging environment. Economically, the pharmaceutical industry has been characterized by high profit margins; this mainly as a result of substantial research and development (R &D) investment and its legal protection by patents. Over time the original situation has evolved further, generating two major types of pharmaceutical firms: originators and generic producers. High R &D investment is a characteristic of the originator pharmaceutical companies which produce patent-protected drugs, as well as biotech specialists which produce biologics. The generic producers, on the other hand, do not incur the initial R &D expenses (or less so) and in general produce drugs lacking patent protection. On top of this now traditional set, new segments have arisen in the pharmaceutical industry, comprising services in or around the traditional drug industry, e.g. diagnostic or data-oriented endeavours.

What defines the process of value creation in pharmaceutical firms? In the long run, it is the role of successful R &D as a driver of value creation. This long-term view of value creation has particular implications: (i) R &D is a critical input to long-term growth and the pharmaceutical sector is one of the highest R &D-intense sectors, (ii) this intense R &D effort is only economically feasible when protected by intellectual property legislation and (iii) successful R &D leading to the discovery of new drugs increases its economic footprint by improving the society’s health status and well-being. The present chapter attempts to outline value creation, value protection and value estimation using the above ideas.

In the pharmaceutical industry value is typically created in one of four business modalities: (1) disease solution providers, (2) breakthrough innovators, (3) commercial optimizers and (4) value players (Behnke et al. 2014; Buldyrev et al. 2020; Clark et al. 2021).

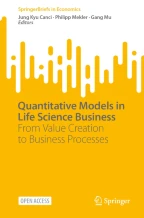

Illustration: Category leadership versus profitability (adapted from Behnke et al. (2014)).

Since the early 2000s building leadership in a particular value creation category has become crucial for success in pharma. Seven of ten leading value creators, e.g. Roche in oncology and Novo Nordisk in diabetes care, generated at least 50% of their revenues from one particular therapeutic area. In some extreme cases (e.g. Biogen in neurology and Incyte in oncology) more than 90% of revenues came from a single therapeutic area.

Category leaders have privileged access to all stakeholders in a given category. This allows them to identify and satisfy unmet customer needs, often at the intersection of science, logistics and marketing. Their product and regulatory functions benefit from more expertise and stronger relationships, enabling them to get innovations to market faster and with a higher success rate. They are well placed to understand and price the best business development opportunities and are a preferred partner for smaller companies to develop and market their products. Lastly, their market presence and strong customer relationships improve commercial efficiency.

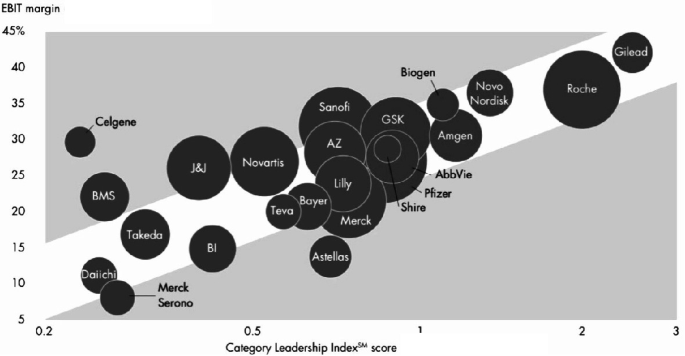

Illustration: Profit growth by business area (adapted from Clark et al. (2021)).

Outside of classical pharma, growth in healthcare services and technology has been accentuated, as old and new players are bringing technology-enabled services to help improve patient care and therapeutic efficiency (Clark et al. 2021). Healthcare services and technology companies are serving nearly all segments of the healthcare ecosystem. These efforts include working with payers and providers to better enable the link between actions and outcomes, to engage with consumers, and to provide real-time and convenient access to health information. Venture capital and private equity have fueled much of the innovation in the space: more than 80 percent of deal volume has come from these institutional investors, while more traditional strategic players have focused on scaling such innovations and integrating them into their core. Driven by this investment, multiple new models, players and approaches are emerging across various sub-segments of the technology and services space, driving both innovation (measured by the number of venture capital deals as a percent of total deals) and integration (measured by strategic dollars invested as a percent of total dollars) with traditional payers and providers. In some sub-segments, such as data and analytics, utilization management, provider enablement, network management and clinical information systems, there has been a high rate of both innovation and integration. For instance, in the data and analytics sub-segment, areas such as behavioural health and social determinants of health have driven innovation, while payer and provider investment in at-scale data and analytics platforms has driven deeper integration with existing core platforms. Other sub-segments, such as patient engagement and population health management, have exhibited high innovation but lower integration. Traditional players have an opportunity to integrate innovative new technologies and offerings to transform and modernize their existing business models. Simultaneously, new (and often non-traditional) players are well positioned to continue to drive innovation across multiple sub-segments and through combinations of capabilities.

In his paper on business innovation and growth (Ahlstrom 2010), David Ahlstrom argues that the main goal of any business is to develop new and innovative goods and services that generate economic growth while delivering important benefits to society. Steady economic growth generated through innovation plays a major role in producing increases in per capita income. Small changes in economic growth can yield very large differences in income over time, making firm growth particularly salient to societies. In addition to providing growth, innovative firms can supply important goods and services to consumers.

Classically, among the more advanced methodologies, static net asset value (NAV)-based valuations have been used to attempt catching the ‘true’ value of a patent. However, it has become increasingly evident that uncertainty in a patent’s life cycle must be considered when performing patent valuation. For these reasons, a new family of quantitative models which account for uncertainty by means of stochastic (Monte Carlo) simulations have been used by several groups and companies.

A key feature of patents in the pharma and biotech industries is that their value is uncertain. There is a large gap between patent value studies and cost-benefit analysis tools. Existing valuation approaches do not consider a patent’s life cycle, an important and unique characteristic of pharma and biotech patents.

Hence, some authors propose a quantitative stochastic model that accounts for uncertainty and solves the problem by means of Monte Carlo simulations. This is done to model the uncertainty in a patent’s value as a stochastic process and use a mean-reverting process to model changes in the value during the patent’s life cycle. Furthermore, one can perform comparative parameter analyses and discuss the implications of the proposed model.

As exemplified by Banerjee et al. (2019), one can classify typical patent valuation approaches into two different groups: an expert approach and a monetary approach. The most intuitive approach is based on expert knowledge, which can be considered easy, often proprietary, and sometimes quite subjective. It mainly relies on comparison metrics, sum-of-parts values and on historical precedents.

The monetary approach, on the other hand, tries to evaluate the patent’s economic value via monetary categories such as cash flow or profit patents may be able to generate in the future. These methods can be further sub-grouped on the basis of their operating approaches: (1) the cost approach, (2) the market approach and (3) the income approach.

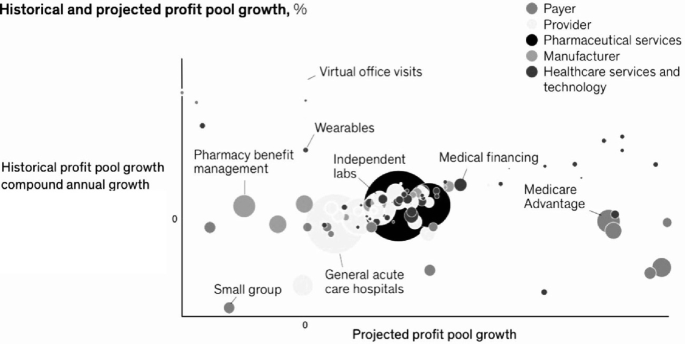

The S-shape curve life cycle of patent value (adapted from Wu and Wu (2011)).

The patent life cycle is modelled as a standard stochastic mean-reverting process (Ornstein-Uhlenbeck mean-reverting).

Initial patent value

Initial expected rate of growth for patent value

Initial volatility of patent value

Half decay rate of the growth of the drift

Long-term drift rate of patent value

Long-term patent value

Here, the model is applied to the case of a pharmaceutical company negotiating a phase 2 patent license. Analysing the uncertainty in the life cycle of the patent’s value in this case reveals the following uncertainties: (i) Although the potential sales of the patent are considered stable, the sales parameter is in fact a pinpoint estimate, and actual sales fluctuate over time. (ii) The duration of phase 3 is unknown. (iii) The life cycle must be considered to reflect the real-world setting.

If the company uses the NPV method to evaluate its patent, the effect of uncertainty cannot be considered because of the pinpoint parameters. Second, the NPV method assumes that revenue flows are pinpoint estimates and constant over time, which is unrealistic for the patent life curve. Given the background, the proposed model describes mean-reverting motions with uncertainties, and the S-shaped life cycle can be used.

Because companies treat patent negotiations as business secrets, obtaining actual case figures is difficult. Nevertheless, the proposed model can be applied easily by inputting different case settings. The model was applied to this case using data reported in the literature.

The starting value \(\left( V_\right) \) of the patent in the initial \( \textrm \& \textrm\) stage is set at \(\$ 1\) million, which indicates that, although the patent is promising, licensing is very risky in this stage. The sales growth \((\alpha )\) is used as a proxy for the patent value, that is, the drift rate is \(10\%\) . The patent value volatility ( \(\sigma \) ) is \(8\%\) annually, which reflects the uncertainty about annual sales, and the reversion rate \((\eta )\) is set at \(2\%\) in this analysis. The long-term patent value \((\mu )\) can be derived from government or institutional surveys.

For example, if the population of patients requiring drug treatment is 1 million worldwide, the population can be indicated in terms of sales. Therefore, an equilibrium level of \(\$ 50\) million annual sales revenues is assumed in the stable stage of the patent life cycle. By managing forecasts after acquiring the phase 2 patent, the company can launch the new treatment 2–3 years after the manufacturing plants have been constructed and the process development has been completed. Within 5–7 years after the launch, the new treatment will grow exponentially and reach stable market sales. In this analysis, it is assumed that the duration (T) of the patent’s life cycle is 20 years.

Interferon beta-1a is a cytokine in the interferon family used to treat multiple sclerosis (MS). Avonex was approved in the US in 1996, and in the European Union in 1997, and is registered in more than 80 countries worldwide. It is the leading MS therapy in the US, with around 40% of the overall market, and in the EU, with around 30% of the overall market. It is produced by the Biogen-IDEC and has been marketed under the trade names ‘Avonex’ (Biogen) and ‘Rebif’ (Merck KGaA). Peak global sales have been around USD 5 bn (Avonex: 3 bn, Rebif: 2 bn) in the period 2013–15.

An analysis of interferon beta-1a/Avonex, based on the potential market and the price that Biogen was expected to charge, yielded a present value of USD 3.4 bn, prior to consideration of the initial development cost. The initial cost of developing the drug for commercial use was estimated at USD 2.875 bn.

At the time of this particular analysis, the duration of patent protection on Avonex was another 17 years, and the then current long-term treasury bond rate was \(6.7\%\) . Using an aggregated stock market analysis, the average variance in firm value for publicly traded biotechnology firms (‘volatility’) was found to be 0.224.

To stochastically estimate the patent value, the Black-Scholes formula adjusted for dividends has been used (as detailed in Sect. 6.1):

The patent value is \(C=3422 e^ \times 0.872-2875 \times e^ \times 0.2076=907\) (USD mn).

Contrast this result with the net present value of this project:

$$\beginAlthough the NPV of the patent yields only USD 547 mn, the Black-Scholes model evaluates the patent fat USD 907 mn. The higher value in the latter case means that the patent holder may take advantage in delaying launch and waiting for better market conditions. Less time to the end of patent life will decline its value because it will increase the cost of delay. As can be seen from this example, patent valuation using real options has led to a higher value than by using NPV. The effect would be even more marked if the NPV is near zero or negative. Hence, real option pricing models can be better value metrics than traditional methods in determining the value of intangible assets based on the benefits of bringing the asset owner.

Category and capability leadership hold the keys to superior value creation and even survival in pharma. Companies that stick to the old model of diversifying assets and spreading R &D bets across many categories will likely find themselves running conglomerates of sub-scale businesses. As the innovation bar for attractive reimbursement rises, they will face low profitability and negative returns on R &D. Category leaders will have more resources to invest in product development, commercialization and acquisitions. Because assets owned by sub-scale companies will be worth more in the portfolios of market leaders, current owners will risk being consolidated by the winners. Copying today’s proven business models does not guarantee future success. Inevitably, today’s leaders will use their market influence to raise the bar for competitors. However, there is good news for companies still building their category leadership positions.

Current leaders face a particular dilemma: leaders that change too early risk losing attractive cash flows from established business models; those that move too late risk being disrupted by emerging competitors. In the recent history of the industry, it seems that leaders have more often erred on the side of holding on to old models for too long, leaving room for more aggressive players to disrupt them. New and innovative business models across verticals can generate greater value and deliver better care for individuals. New and innovative business models are beginning to show promise in delivering better care and generating higher returns. The existence of these models and their initial successes are reflective of what we have observed in the market in recent years: leading organizations in the healthcare industry are not content to simply play in attractive segments and markets, but instead are proactively and fundamentally reshaping how the industry operates and how care is delivered. While the recipe across verticals varies, common among these new business models are greater alignment of incentives typically involving risk bearing, better integration of care, and use of data and advanced analytics.

The pharma industry continues to evolve, with potential disruptions affecting all parts of the value chain, from R &D to patient care. The future success of today’s market leaders will be determined by how they react to these changes. Pfizer has already started to apply its commercial optimizer model in specialty businesses. And many companies struggle to repeat breakthrough innovation in a particular disease area, because competitors soon close the gap with similar products. To stay ahead of the competition, breakthrough innovators often evolve into disease solutions providers in the categories they helped create. In oncology, for example, Roche has been building a sophisticated business system on the strength of its breakthrough cancer therapies. Future winners will actively disrupt current business models, including their own. For example, pricing models will increasingly shift from per-pill pricing to outcome-based and at-risk models. Disease solution providers will move to own ‘episodes of care’, including diagnostics, drugs, devices and treatment protocols.